Our paper „Long-Term Volatility Shapes the Stock Market’s Sensitivity to News” (joint with Christian Conrad, Heidelberg University, and Nikoleta Tushteva, European Central Bank) is forthcoming in the prestigious Journal of Econometrics.

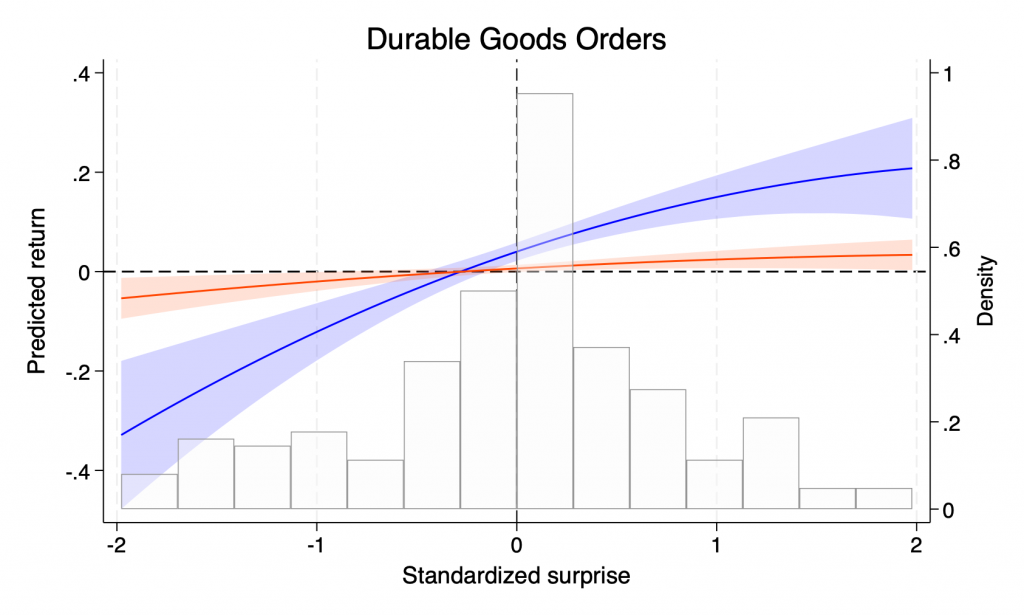

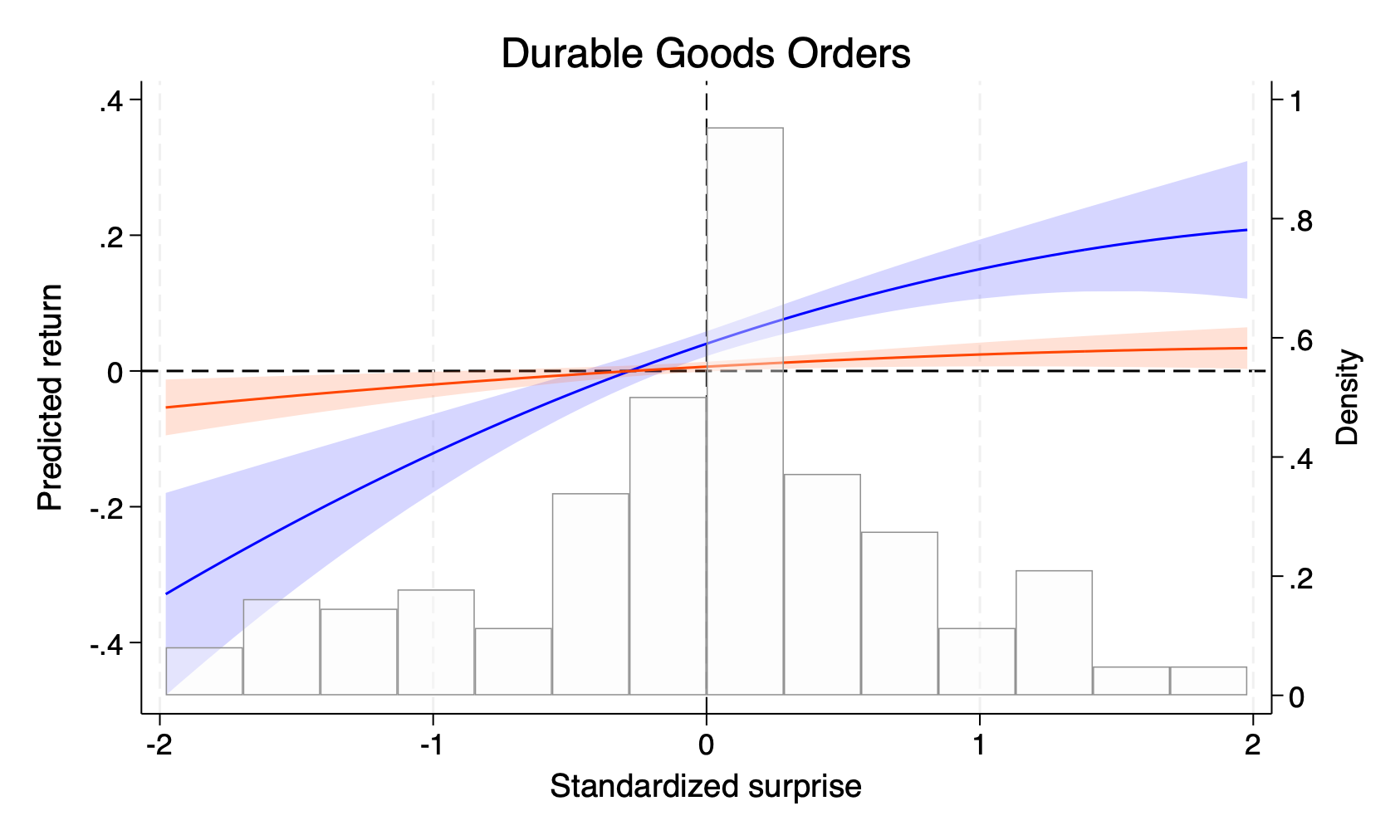

Macroeconomic announcements are scheduled releases of economic data and indicators by government agencies, for instance, the publication of consumer confidence or the Consumer Price Index (CPI). These pre-scheduled announcements are published at regular intervals, e.g., at a monthly frequency, and these announcements are responsible for a large share of return fluctuations in stock markets. In the paper, we examine how the U.S. stock market, as measured by the S&P 500 index, responds immediately to surprises in these major U.S. data releases. These surprises are defined as the difference between the announced figures and what financial market experts had expected. We show that this instant reaction depends crucially on the level of long-term stock market volatility. When long-term volatility is high, stock returns move more strongly in response to news, and there is a pronounced asymmetry in the response to both good and bad news. In the paper, we explain these patterns using an asset-pricing model that combines the Campbell–Shiller log-linear present value framework with a two-component volatility model for the conditional variance of cash flow news, and allowing for volatility feedback. In our model, innovations to the long-term volatility component are the most critical driver of discount rate news. Large macroeconomic surprises trigger upward revisions in these required returns, which dampen the effect of good news on stock prices and amplify the impact of bad news.

My special thanks go to Christian Conrad for his mentorship and collaboration throughout the three and a half years we have been working on this article. A big thank you to all those who contributed valuable feedback along the way. Our research benefited greatly from the insightful comments and feedback we received from seminar and conference participants at over 20 presentations across ten countries. Moreover, I thank the German Federal Ministry of Education and Research (BMBF) and the Baden-Württemberg Ministry of Science, as part of Germany’s Excellence Strategy, for the funding.

Link to the paper:

If you want to use the MF2-GARCH (from Conrad and Engle, 2025) to estimate and forecast financial market risks, try the MF2-GARCH Toolbox for MATLAB:

Comments are closed